Revalidation woes – Banks adding fuel to fire

It has been now over two months since the income tax department launched its new portal but users continue to face glitches. In the meantime the deadline of 31st August 2021 for revalidating old income tax exemption certificates u/s 12A or 12AA (now 12AB) and tax deduction certificates u/s 80G is fast approaching.

Income tax should extend the deadline

It would be only in the fitness of things for the Income tax department to further extend the due date. Charitable trusts and institutions are ready and willing to comply with this new requirement of Income tax introduced under the Finance Act 2020. However, they cannot and should not be faulted due to their inability to comply due to a faulty new portal.

Banks threatening to block accounts

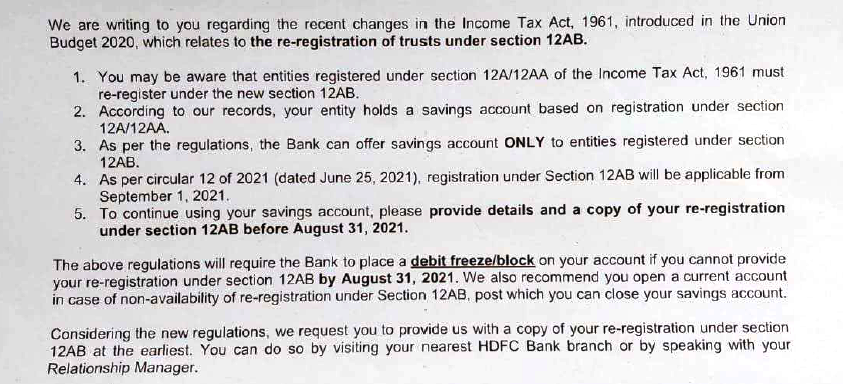

In the meantime, certain Banks have started threatening some trusts that if the revalidated certificate is not provided by 31st August 2021 the bank would place a “debit freeze/block” on the account. This is absurd. Who has authorized banks to do so? Is there such a directive from the Ministry of Finance or the Income tax department or the Reserve Bank of India?

It gets even more interesting when these banks add a caveat that that they recommend opening a current account in case of non-availability of revalidation u/s 12AB and post which the savings account can be closed. We fail to understand what is the connection between having a tax exemption certificate and a savings account? Are Banks implying that a charitable trust or institution can operate a savings account only if it has a tax exemption certificate? If yes, is there any Reserve Bank of India guideline, circular, notice or directive in this regard?

Here is the relevant screenshot of a letter sent by a well-known private bank to a equally well known public charitable trust.

Jinxed since June

The new portal was launched on 7th June 2021 but has since been at the receiving end of criticism because of the problems faced by taxpayers in filing returns and in availing of other services.

The country’s second largest information technology company, Infosys, is the service provider for this portal: https://www.incometax.gov.in

From filing a tax return to accessing credit statements to verifying returns online as well, taxpayers are struggling with this “extremely slow” website. The fact that many features, including some tax return forms, are still missing is only adding to their problems.

The new I-T portal was given cabinet approval in January 2019 and the contract was awarded to Infosys through a bidding process. Since then, the government has paid Infosys Rs 164.5 crore for the project.

Advisory

- Please continue in your efforts to apply for revalidation of your tax exemption and tax deduction certificates in online Form 10A.

- Please raise your grievance at the E-filing Portal with detailed facts and screenshot of the error.

- Please pray that the due date gets extended or the glitches get repaired

- Please do not fall prey to banks wanting to take advantage of your current vulnerability