Date for re-validating tax exemption & deduction extended

The Government of India seems adamant about putting charitable as also religious trusts and institutions through the exercise of revalidating their tax exemption and tax deduction registrations. The only relief provided is by way of extending the effective date from 1st June 2020 to 1st October 2020.

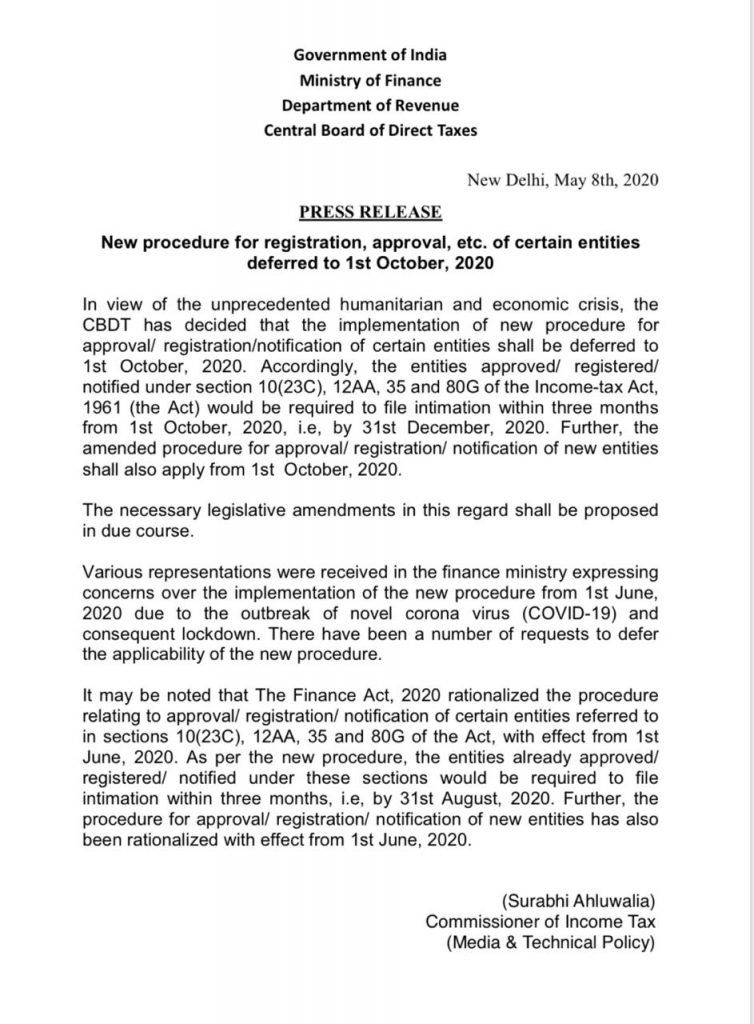

Press Note of Ministry of Finance

The Ministry of Finance has released a press note titled: “New procedure for registration, approval, etc. of certain entities deferred to 1st October, 2020”.

The note states: “Entities approved/ registered/ notified under section 10(23C), 12AA, 35 and 80G of the Income-tax Act, 1961 (the Act) would be required to file intimation within three months from 1st October, 2020, i.e., by 31st December, 2020.”

The term used by the Ministry of Finance is “file intimation”. This gives one an impression that this may not be a process of ‘Reregistration’ but simply a process of filing online intimation or informing the Income tax authorities that the trust or institution is interested in continuing its registration. One really hopes this is the case.

However, as we all know the Ministry of Home Affairs (MHA) under the Foreign Contribution Regulation Act (MHA) 2010 also requires organisations registered under FCRA 2010 to “provide intimation” if there is change in the FCRA Bank account or utilization account etc. However, what MHA means by “provide intimation” is in fact a process in obtaining written “prior approval” from MHA and until such written permission is issued by MHA the change cannot be implemented by the organization.

Thus, in the government of India’s dictionary the term “intimation” has a very different and deeper meaning than what is commonly or universally understood.

The note also states: “The amended procedure for approval/registration/notification of new entities shall also apply from 1st October, 2020. The necessary legislative amendments in this regard shall be proposed in due course.”

The Ministry of Finance is referring here to trusts and institutions which may have been recently established and may be applying to income tax authorities for the very first time under the newly introduced concept of “provisional approval”.

Limited relief

Very clearly the Government of India is keen on going ahead with implementing their new policy under the Finance Act 2020 and which will require all charitable and religious trusts and institutions to revalidate their 12AA, 10(23C), 35 and 80G registrations.

The only relief provided is by way of postponing implementation from 1st June to now 1st October 2020.

As per Finance Act 2020 all existing charitable and religious institutions already registered under Section 12A (trusts and institutions registered prior to 1996), Section 12AA (trusts and institutions registered after 1996), Section 10(23C) (certain educational and medical institutions) and Section 80G are required to re-apply to the income tax authorities to revalidate their existing registrations.

As per Finance Act 2020, this exercise was to commence on 1st June 2020 and close on 31st August 2020. In other words, charitable trusts and institutions were given a limited window of three months to apply online for revalidating their income tax registrations. However, in view of the Covid-19 pandemic, lockdowns and other challenges, this exercise will now commence on 1st October 2020 and close on 31st December 2020.

Process

Finance Act 2020 received the assent of the President of India on 27th March 2020 and is now already law.

Once the Rules and online forms are drafted and ready there will be a window of three months (now 1st October to 31st December 2020) within which application must be submitted.

Trusts and institutions may apply on their own or perhaps through their auditors/practicing chartered accountants.

Validity

After processing your application, your trust or institution’s registration under section 12A or 12AA or Section 10(23C) and 80G may be revalidated by income tax for a period of five years.

Application for renewal after five years must be made at least six months prior to the expiry of the five years validity period.

The concept of five years validity seems to have been borrowed by the Ministry of Finance from the Ministry of Home Affairs. Many will recollect that the concept of revalidating registration under FCRA was introduced by MHA for the first time in December 2015.

Interestingly the validity of FCRA registration of most NGO will expire on 31st October 2021 and applications for renewal can be made one year to at least six months in advance and this means charitable and religious trusts and institutions will also be preparing for renewing their FCRA registration from November 2020 onward.

Provisional registration for new entrants

Newly established trusts and institutions applying to income tax for registration for the very first time will be given provisional registration for three years. This is a new concept.

Once granted, the provisional registration shall be valid for three years from the Assessment Year from which the registration is sought. Thereafter, application for renewal or rather registration (instead of provisional registration) can to be submitted at least six months prior to the expiry of validity period of the provisional registration and registration so granted shall be valid for five years.

What if registration is not revalidated?

Unfortunately, if the income tax authorities refuse to renew or revalidate your trust or institution’s registration as a tax-exempt organization established for a charitable or religious purpose, the following would be the consequences:

- The total income of your trust would become taxable, including all voluntary donations and grants received during the financial year;

- If the trust or institution is de-registered u/s 12A or 12AA, Section 115TD of Income tax (introduced vide Finance Act 2016) would be invoked and there would be an additional tax (at market value) on the assets (e.g. land, building, investments in shares, if any) of the trust or institution.

Will revalidation of tax exemption & tax deduction certificates be automatic?

Will the process be simple or complex? Will it be seamless automatic renewal for all those who will be applying online and have been filing their returns annually on time and complying with all other statutory requirements under the Income tax Act 1961?

Will the tax authorities be demanding resubmission of old records? Unfortunately, there are many old trusts which have misplaced their registration certificates and trust deeds.

Will the tax authorities be re-examining the objects and activities? If yes, does the department have the capacity and infrastructure to scrutinize 2,17,000 applications in detail within a reasonable period of time?

We are not sure as yet if this will be an exercise in re-registration (with detailed submissions and scrutiny) or automatic re-validation. We all do hope and pray it will be the latter. But what if it is the former?

What could prove disastrous?

We have been observing that in recent years the income tax authorities have been denying registration u/s 12AA for totally irrelevant reasons well beyond the scope of enquiry contemplated u/s 12A of the Income Tax Act 1961. For example, it is a settled position under law that once settled, a trust is ‘irrevocable’, but Income tax authorities insist that the ‘irrevocability’ clause should be explicitly stated in the trust deed.

We all know that there is no explicit provision under the Public Trusts Act to dissolve or wind up a trust and yet the income tax authorities insist that there should be a clear clause in the trust deed for winding up or dissolving the trust. There are virtually thousands of old trust deeds which simply do not have these clauses. Will the Income tax authorities insist that these trusts should amend their trust deeds? If the answer is yes, brace yourself for further delays in revalidating your tax-exempt status till the charity commissioner approves amendment to your trust deed.

In our opinion, clauses like ‘irrevocability’ and ‘winding up’ are desirable, but not a pre-condition under the Income Tax Act for granting registration for tax exemption.

Income tax authorities also insist that the trust deed or memorandum of association should have a clause that the beneficiaries are a section of the public and not specific individuals and that the funds and property of the trust shall be used only for the objectives of the Trust, Society or Non-profit Company.

Will the Income tax authorities insist that all trust deeds and memorandum of associations must mandatorily have these clauses? Would it not suffice if trustees or members of the governing board submit a signed undertaking or affidavit that these norms will be adhered to and the income tax authorities may cancel registration in case of any violation?

Honestly, we don’t have the answers to any of these doubts, queries and concerns that we keep receiving. We will get a clear idea only once the Central Board of Direct Taxes (CBDT) drafts the Rules and prepares the new online forms.

Other changes under Finance Act 2020

National Register & UIN

The Government of India also proposes to create a National Register of all charitable and religious institutions and the Income Tax Department will issue a Unique Identification Number to all charitable and religious institutions.

In our opinion this would be a good initiative and help with proper collection of data and analysis of that data.

Either 12AA or 10(23C)

Currently, several hospitals, schools and colleges are registered simultaneously under section 10(23C) and 12AA. Often, if exemption is denied under 10(23C), the institution seeks cover under the backup registration under 12AA.

Charitable trusts and intuitions currently registered under both 10(23C) and 12AA will now be required to decide whether they prefer to apply for revalidation or renewal of either the registration u/s 10(23C) or 12AA, but not both. Those currently registered u/s 12AA or 12A will now be registered or revalidated under the new Section 12AB.

Additional new compliance u/s 80G

Every charitable trust or institution registered u/s 80G shall be required to submit a statement of donations received in such form & manner as may be prescribed & the benefit of 80G shall be available to donors on the basis of information relating to donation furnished by the corresponding charitable trust or institution.

End note

- Ministry of Finance has only provided ‘temporary relief’ by extending the date of implementation.

- Petitions made to the Prime Minister and the Finance Minister requesting them not to increase administrative burden for both the income tax authorities as also the voluntary sector appears to have fallen on deaf years.

- In the meantime, charitable and religious trusts and institutions can continue to enjoy tax exemption and offer their donors (if any left after Covid-19 and PM CARES) tax deductions under section 80G of Income tax.

- Please note that even between 1st October 2020 to 31st December 2020, existing registrations under section 12A, 12AA, 10(23C), 35 and 80G shall remain valid.

- One hopes that all applications (“intimations”) filed between 1st October to 31st December 2020 by over 2,17,000 registered organisations will be processed by the income tax authorities by the end of the financial year 2020-21 (i.e. by 31st March 2021).

Stay Positive

We certainly do not want any of our colleagues at work or in the voluntary sector to be ‘Covid Positive.’ But we certainly want them to remain positive in the attitude and approach to all the challenges that this year has brought home. ‘Duty bound while home bound’ is the maxim by which most of us will remember the year 2020.

This year is and will remain a challenging year for everyone. However, according to the Chinese, the year 2020 is the ‘Year of the Rat’ and the rat is a symbol of astuteness and adaptability. Our success and sustainability will largely depend on how smartly we navigate each hurdle that comes along the way and how quickly and effectively we adapt to the rapidly changing circumstances.