CAP supports companies, large corporate foundations, and startups, small and mid-sized non-governmental organisations (NGOs). The latter require and avail themselves of our services the most. In such instances, all we request them to do is enroll as CAP Affiliates, which entitles them to our advisory and capacity building assistance. The revenue we generate through such Affiliate fees is modest, and therefore cross-subsidies and donations are essential to sustain our work.

Compliance Advisory

Capacity Building

Corporate Support

Resources

Your money makes a deep impact on multiple NGOs

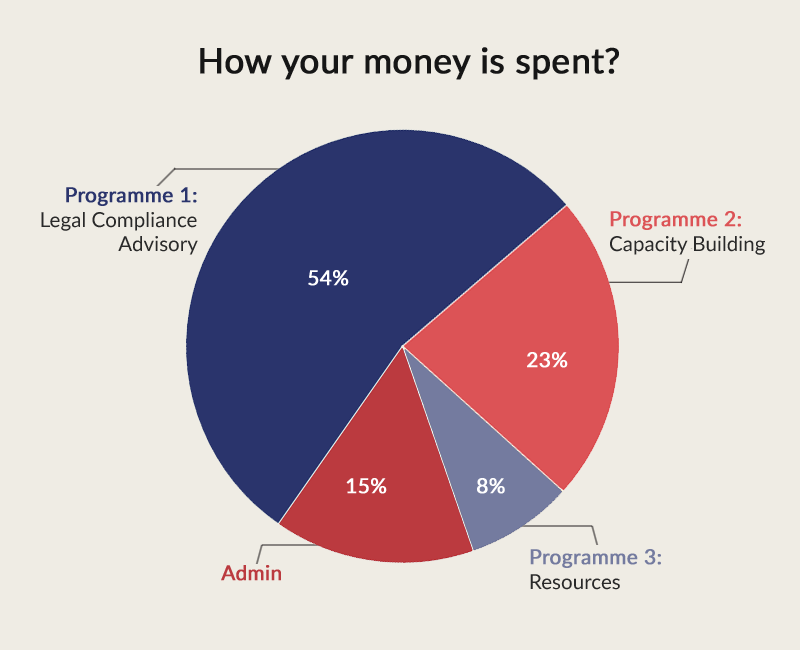

Your donation to CAP will be an investment towards a legally compliant and well governed voluntary sector in India. It will help CAP to continue guiding and advising NGOs on all legal, fiscal, governance, and resource-related matters. Your donation will also support CAP’s various capacity building programs for voluntary organisations. Thus, by donating to CAP, you are in turn, donating to the different NGOs, helping them stay compliant. This, in turn leads to a more principled and ethical sector.

CAP is supported by

- John & Editha Kapoor Foundation

- Cipla Foundation

- A.T.E. Chandra Foundation

- H T Parekh Foundation

- Forbes Marshall

- N M Wadia Charities

- Sponsor a workshop participant’s fees (Rs 1500/- or Rs 2500/-)

You may gift/sponsor a participant’s fee for any CAP workshop.

- Sponsor an NGO’s Annual Affiliation fees (Rs 20,000/-)

Many NGOs would like to avail of our services but cannot afford the fees. You could sponsor the annual Affiliate fee on their behalf.

- Sponsor an issue of the CAP Magazine (80,000/issue)

Donors can place their names/advertisement on the outside back cover of the magazine.

- Donate to our corpus

Any amount towards strengthening the CAP corpus would be beneficial for us to continue our work.

Compliance Status

CAP is registered as a nonprofit organisation under Section 8 of the Indian Companies Act, 2013

CAP’s income is tax exempt under Section 12A and all donations to CAP are eligible for a 50% deduction under Section 80-G of the Income Tax Act, 1961

CAP is also eligible to receive foreign contributions under the Foreign Contribution Regulation Act, 2010

If you are considering supporting our services, there are a number of simple ways you can do so.

- By Bank Transfer NEFT

Citizens of Foreign country

Overseas Citizens of India

Foreign Foundations

Foreign Companies

Multinational Companies

– click here

Indian Citizens

Non-Resident Indians

Indian Foundations

Indian Companies (including companies having more than 50% foreign investors.

– click here

- By Cheque

You may send a cheque drawn in favour of Centre for Advancement of Philanthropy to our registered office at the following address:

Centre for Advancement of Philanthropy

4th Floor, Mulla House

Behind Flora Fountain

Fort, Mumbai – 400 001

- Credit Card

- Any citizens of a foreign country, including a person of Indian origin who is now a citizen of foreign country, as also institutions (for-profit or non-profits) registered in a foreign country are all treated as “Foreign Source” under FCRA 2010 and as such their donations/grants must be received only in CAP’s specific FCRA Bank account with Standard Chartered Bank AC. No: 22111006607

- Any individual who is an Indian citizen including Non-Resident Indian (NRI) who has not taken citizenship of another country and holds Indian passport is not treated as “Foreign Source” under FCRA 2010 and as such their donations/grants must be received in CAP’s regular or local Bank account, with Central Bank of India AC No: 1721311396