Charity Commissioner extends due date for filing annual returns but no other relief

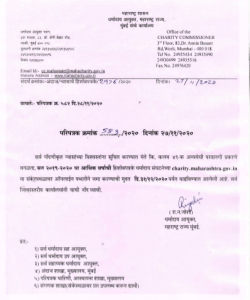

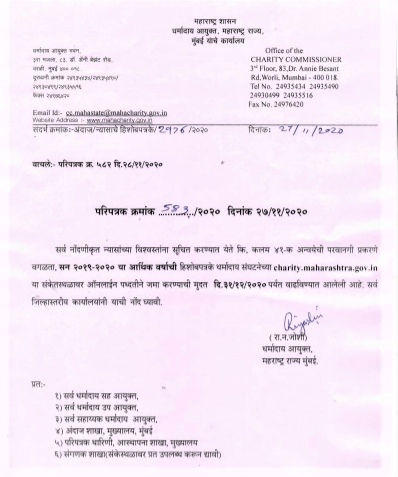

The office of the Charity Commissioner (Maharashtra State) vide Notification dated 27th November 2020 has extended the last date for filing online annual returns and audited statements of account for the financial year 2019-20 to 31st December 2020.

New requirement

Extending the last date for filing the annual returns comes as a relief to over 800,000 religious and charitable trusts and societies reportedly registered with the office of Charity Commissioner’s in Maharashtra.

However, the department now requires the ‘Trust Accounts Submission Verification Form’ to be signed by three trustees instead of two as was earlier the case.

No clarity on ‘virtual/online meetings’

While virtual meetings are officially recognised under the Indian Companies Act 2013, online or virtual meetings are not yet officially recognised under the Maharashtra Public Trusts Act 1950 or the Societies Registration Act 1860 or similar state legislation as yet.

There is no official circular or notification about validity of online/virtual meetings for Trusts or Societies. However, considering the pandemic and requirement of social distancing ‘virtual meetings’ using technology (Skype, Zoom, Google Meet, Web-ex, etc.) is a good, practical and safe option under the given circumstances and should be officially recognized with a circular or notification.

Most, if not all the online Apps also provide facilities to record the meeting which should be adequate proof of who was in attendance and what was discussed, decided and resolved.